“Some of the best investments are found in hyper-competitive low margin industries. That’s when competent management makes the difference - and can take a disproportionate amount of market share” - Wall Street Critic

Investment Thesis

We present SP Plus Corporation (NASDAQ: SP), a pure play parking company that is poised for a killer comeback in the next 12-18 months. We believe SP Plus is well equipped with their current executive team and will move quickly to capture long term parking contracts with their superior tech stack. Parking operators have traditionally been earmarked as cash-cows with private equity firms quick to snap them up. As SP Plus is the only publicly traded parking operator, we sought to discover if it was a compelling value situation. After extensive DD, we believe SP Plus is one of the best alpha generation ideas of 2022 based off these factors:

As public health policy regarding the pandemic shifts from a mitigate to adaptive mindset, earnings will return to normalcy & will be coupled with strong EPS growth (however, we do expect SP’s multiple to compress)

SP Plus is poised to take significant market share in a low margin industry due to a all encompassing parking technology product, Sphere

SP Plus has a veteran management team in place which seems primed to run up the scoreboard on second rate parking operators

Post Pandemic Tailwind

During the pandemic, analysts took aim at how Covid-19 impacted the economics of airlines, cruises, and the hospitality industry. As if a forgotten child, parking operators were infrequently discussed despite the pandemic wreaking havoc on their operations. SP Plus’s earnings from fiscal year 2019 to FY 2020 were cut by a nasty 84%; FY 2021 estimated annual earnings are only expected to be at 71% of the levels last seen in FY 2019 (Q4 earnings pending which we touch on below).

SP Plus was forced to shift the majority of its commercial line of business from a lease model of lots to management contracts. Currently, management contracts compromise 86% of its commercial segment which represent 71% of its 2021 revenue thus far (FactSet). Furthermore, SP Plus has made strides to eliminate certain G&A costs permanently hence making the company more cost dynamic. Based off management & analyst commentary, we anticipate SP Plus’s CFO to shed more light on lowering costs in the Q4 earnings call.

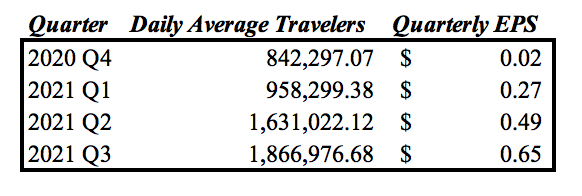

SP Plus’s aviation sector has been lagging behind as post pandemic travel fails to fully recover. For context, travel currently makes up 27% of SP Plus’s revenue. We sought to interpret how TSA checkpoint data correlated with SP Plus’s earnings. We discovered that SP Plus’s past 4 quarters of earnings and TSA daily average travel numbers in their respective fiscal quarters have a correlation (R^2 value) of 91.57%. The average of daily travelers for Q3 came in at 1,866,977 as SP Plus reported earnings of $0.65 a share. Given the Q4 daily average traveler number is 1,887,723, we believe SP Plus will surpass analysts expectations of $0.53 EPS when Q4 earnings report on February 23, 2022—we estimate they come in at $0.64 for Q4. For those statistically curious, here are the numbers below:

A Boring Business With Excellent Tech

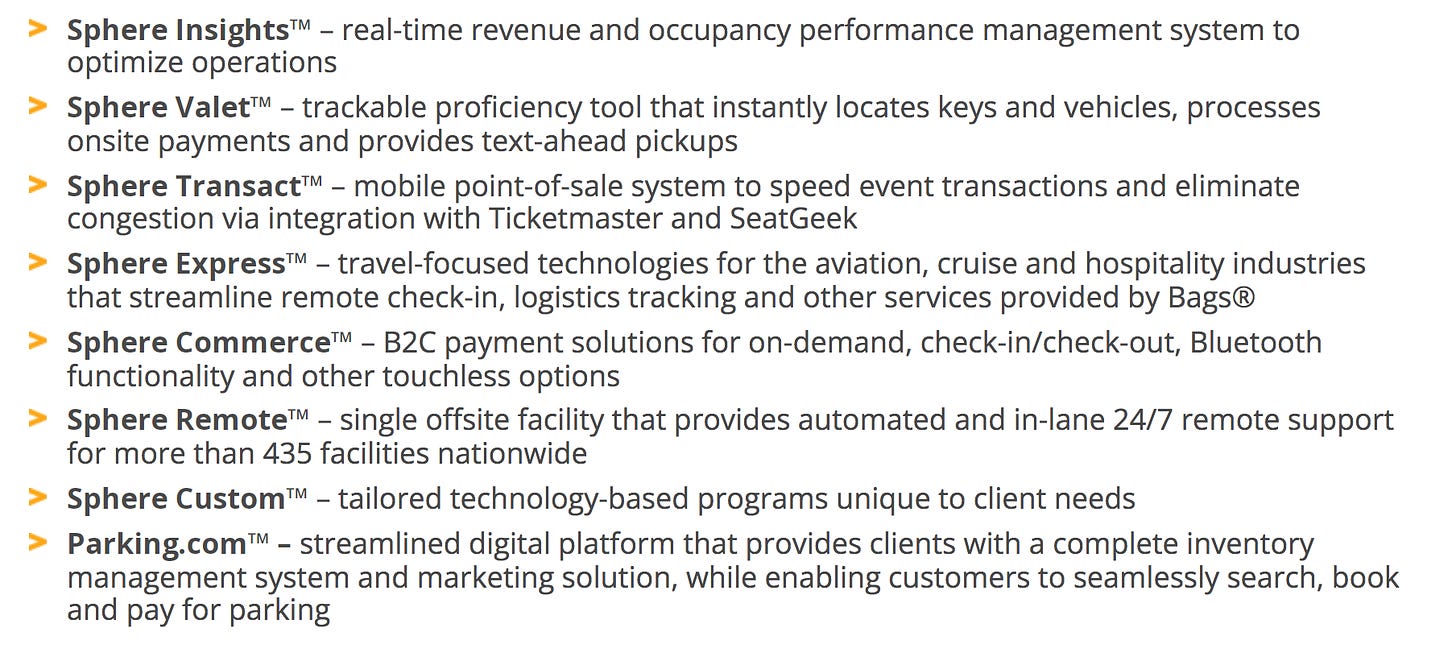

Given the stickiness of SP Plus’s commercial segment (91% annual retention rates), we sought to understand the key driver of contract retention and how SP differentiates itself in the marketplace. Shockingly, we discovered that SP Plus has a stellar parking tech business bundled into what we initially regarded as a boring business. Sphere, SP Plus’s parking technology product, has been instrumental in winning new clients and pleasing current ones based off management commentary and customer conversations. This graphic speaks more concisely to what Sphere does

The results of Sphere speak for themselves:

SP Plus won Innovative Organization of the Year by the National Parking Association (I was shocked such an org existed)

FY ‘21 Q3 transactions on parking.com were up 50% from Q2

SP landed a big commercial contract with the University of Toledo to manage more than 10k parking spaces; we anticipate SP Plus will push further into university parking as Sphere gives students a low-friction pay for parking experience via their smartphone

Channel checks conducted at different facilities managed by SP Plus with Sphere capabilities implemented prove that the pay for parking via smartphone is nearly idiot-proof

SP Plus is progressively winning new commercial contracts as well as new airport parking/shuttle deals (the Q3 transcript dives deeper into this)

The A-Team of Parking Veterans

SP Plus’s management team is compromised of an excellent group of individuals who know the ins and outs of the parking game. Significant institutional ownership in SP Plus (87%) conveys great trust in current management. Several key SP Plus executives such as CEO (Mark Baumann), Commercial Division President (Rob Toy), and Airport Division President (Jack Ricchiuto), have all been with the company for 20+ years. They have incredible insight into the parking industry and seem antsy to bounce back from the pandemic. Baumann’s comment on the Q3 earnings call hint at the comeback story of SP Plus.

“In our commercial segment, we began servicing 69 new locations during the third quarter. This success has been a function of SP Plus' track record of providing superior service and offering innovative technology solutions. And we believe that some of our competitors have not performed up to expectations. Given how we have helped our clients navigate during the pandemic, together with our financial stability and our award-winning innovations, we believe that owners now see us as the provider of choice versus other competitors who they may have considered in the past.”

I purposely attached the entirety of this tidbit to provide more color—the key phrase here is, “we believe that owners now see us as the provider of choice.” With the pandemic exposing second-rate parking operators, SP Plus’s veteran management team is poised to capitalize given their track record and tech offerings.

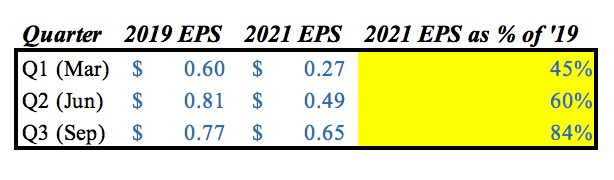

Positive Asymmetric Return

God forbid another all out pandemic, we believe the downside in SP Plus is limited as the company has shown strong signs of a comeback. We estimate SP Plus annual earnings in FY 2022 will be 85-90% of those seen in FY 2019. In the chart below you can see the return to earnings normalcy in relation to 2019 quarterly earnings:

Assuming SP Plus hits a conservative 85% of FY 2019 earnings, we see $2.32 in EPS for FY ‘22 (this falls below analyst estimates of $2.41). Given SP Plus current share price of $26.71; we can anticipate a forward P/E of 11.5. We personally think SP Plus will trade closer to the 14-16x P/E range this time next year based off historical multiples. With a 52-week beta of .75, we believe SP Plus is one of our best alpha generation ideas this year.

With a conservative EPS estimate for FY ‘22 of $2.32 & assuming a 14x P/E; we’re setting a price target of $32 representing upside of 22%.

On a side note, I would like to thank those that subscribed following my debut report. I am open ears to feedback on this long piece and willing to field any questions in the comments or via email.

Have a stellar week,

Peabody

Disclaimer: This report is entirely for entertainment purposes and should not be considered investment advice. I do not currently own SP Plus; however I may opt to initiate a position in the future.