Professional Misconduct, Luxury Apartments, An IPO Bailout & More

Dear Readers,

Today, we publish a short report on Regencell Bioscience Holdings (NASDAQ: $RGC), a $450M Traditional Chinese Medicine company with no revenue, a strategic research partner guilty of professional misconduct, and a taste for high end corporate apartments in Hong Kong.

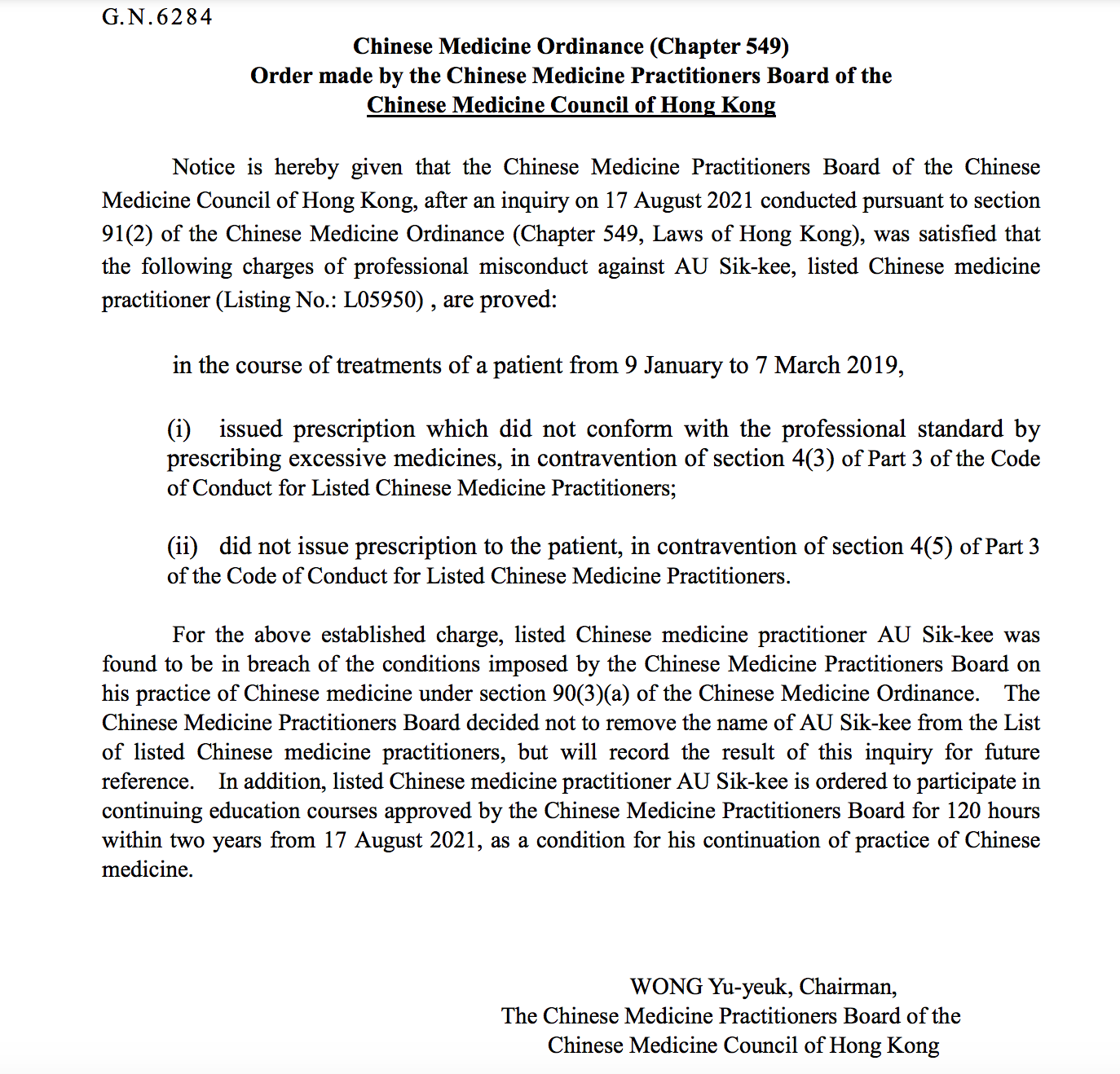

The Strategic Research Partner Guilty of Professional Misconduct

Regencell is a developmental stage company based in Hong Kong which focuses on producing Traditional Chinese Medicine (TCM) cures for ADHD & ASD. To date, it has recorded zero revenues and is currently in the developmental stage of creating Traditional Chinese Medicine formulas. Regencell relies heavily on its Traditional Chinese Medicine strategic partner, Sik-Kee Au, who happens to be the father of the CEO, Yat-Gai Au. This comment in Regencell’s 2021 20-F underscores the significance of the role Sik-Kee Au has in dictating success or failure of the company:

“We are wholly dependent on certain key personnel and our strategic partner, Mr. Sik-Kee Au, the father of our founder, director, and CEO, and loss of these individuals could have a material adverse effect on our business, financial condition and results of operations.”

Sik-kee Au granted Regencell the exclusive rights and ownership of all his Traditional Chinese Medicine formulas as well as exclusive IP rights. Au is a listed Chinese Medicine Practitioner in Hong Kong operating under the listing number: 05950.

Upon due diligence, we discovered that Sik-Kee Au was found guilty of professional misconduct in August 2021 by the Chinese Medicine Practitioners Board of the Chinese Medicine Council of Hong Kong. Sik-Kee Au was found guilty of overprescribing medicine and failing to issue medicine of a patient from January 9, 2019 to March 7, 2019. Beyond Au’s professional misconduct, we question his abilities to dedicate time to Regencell in Hong Kong given he maintains a $4.5M compound in San Jose, California per his reported address on charitable donation records.

Ironically, Regencell’s first study which was overseen by Sik-Kee Au was conducted between November 2018 and March 2019. The study comprised of 7 patients ranging from 5 to 12 years old, with patients being treated with personalized formulas created by Sik-Kee Au. Regencell claimed the trial went well stating in their 2021 20-F:

“Within three months of using our TCM formulae, our research showed that the enrolled patients had attained better speech, communication, sociability, cognition and behavioral abilities. The enrolled patients using the personalized TCM formulae prescribed by the TCM Practitioner (Sik-Kee Au) also experienced better bowel movement, sweating and temporary fatigue as part of the improvement process.”

However, we question the validity of Regencell’s positive reporting based on the following:

Sik-Kee Au being found guilty of professional misconduct during the time window in which he was conducting Regencell’s first trial places speculation that the misconduct charge might have stemmed from treatment conducted during the trial

We inquired to the Chinese Medicine Practitioners Board of the Chinese Medicine Council of Hong Kong via email over the specifics of the case but they declined to offer additional information

Secondly, we are curious as to why none of this research was carried out in a controlled, scientific environment as Regencell was reliant on feedback from the parents of their patients. This combined with zero peer review of the study, or any peer review of Au’s work, makes us question the validity of the study as whole.

Regencell publicly acknowledging that their “strategic research partner” was proven guilty of professional misconduct, especially during the time period in which their first trial was conducted, would likely cause significant damage to the share price. Should Sik-Kee Au fail to complete his mandated continuing education hours; it could jeopardize the entirety of Regencell’s future. Failing to disclose Sik-Kee Au’s professional misconduct to investors should be an immediate red flag.

Smoke & Mirrors

Regencell’s Covid-19 candidate, RGC-COV19, chose to enter a joint venture with Honor Epic Enterprises Limited (BVI shell company) to form Regencell Asia. The investor behind Honor Epic Enterprises is Ji Yang Lee. Ji Yang Lee serves as the “deputy CEO” of SKS worldwide, a manufacturer of customized hotel, hospital, and corporate furniture. This is as if Hilton’s CEO is teaming up with Pfizer to spin up the next round of Covid-19 vaccines.

In addition, Ji Yang Lee currently serves as the CEO of Regencell Asia, the joint venture he and Regencell created to produce a Traditional Chinese Medicine formula for Covid-19. We were unable to verify Lee’s employment with SKS worldwide as the company’s email address is invalid. Furthermore, we were unable to find any information on Ji Yang Lee outside of information Regencell has provided.

Regencell reported favorable results from the Covid-19 candidate, reporting 36 of 37 patients had “had all symptoms eliminated, save for Sensory Dysfunction & occasional cough, within the 6-day treatment period.” With this being said, Regencell was careful to note that the result “have yet to be peer reviewed.” Given Sik-Kee Au’s direct involvement in the course of this trial, we are skeptical that the results are entirely truthful. Furthermore, the trial was conducted respectively in the U.S. and Malaysia. Given Sik-Kee Au’s infraction with the Chinese Medicine Practitioners Board of the Chinese Medicine Council of Hong Kong, it is possible Au opted to conduct these trials outside of Hong Kong to avoid further penalties from the Council.

While we’re sure Regencell is busy whipping up a cure for Covid-19; they happen to have found some free time to go lease not one but two stunning luxury “corporate” apartments.

Flat B on the 35th Floor of Tower 9 at Leighton Hill is quite swank. While we are not able to find the exact unit rental listing, you can deduce from the google reviews and the fact that monthly rent is $6,800 that the place is pretty swank. Moving onto the next property, Flat C on the 16th of Tower 3 at Ultima is a pretty sweet deal for only $7,400 for a month—the unit sold for $4.9M in 2021. Below we attached a layout of the Ultima unit Regencell currently rents. To the common man, this does not look like a typical “corporate apartment.”

Why any executive or shareholder for that matter would condone spending $14k a month on luxury apartments is beyond me. Our best guess is that the father and son Au duo use these for “corporate purposes” as stated in their most recent 20-F.

An IPO Bailout

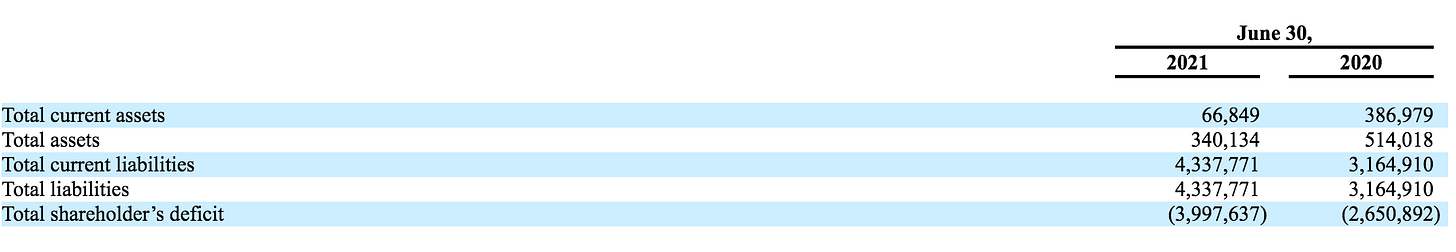

Regencell has an interesting IPO story with the company going public on July 16th, 2021. A few weeks prior to the IPO, the company appeared to be on the edge of going under based off their most recent 2021 20-F. For example, the company only held $67k in cash on June 30th, 2021. Furthermore, there was negative shareholder equity of almost $4M. Regencell burned roughly $112k per month according to their 2021 20-F hence it appears Regencell was on the brink of closing up shop at the end of June.

As if a saving grace, a convertible debt agreement for $3.25M between the CEO, Yat-Gai Au, and Regencell was struck on June 30th, 2021. The convertible note allowed Au to redeem the note in exchange for $3.25M worth of shares marked at the IPO offering price of $9.50. On July 20, 2021 Au opted to redeem his convertible note in exchange for 324,105 ordinary shares of Regencell. While Au owns roughly 80% of the company, we believe this convertible note was constructed as a way for him to keep the company afloat prior to the IPO while indirectly diluting shareholders. American investors further came in giving Regencell $21.8M in net proceeds with their IPO. Below is how Regencell plans to spend their IPO proceeds. Notice how there is no mention of earmarking IPO dollars for commercialization yet product commercialization is necessary for Regencell to generate even a single dollar of revenue.

“We have earmarked and have been using the proceeds of the initial public offering as follows: approximately $2.9 million for second research study; approximately $9.4 million for staff salaries; approximately $4.3 million for facilities rental, renovations and equipment; approximately $2.8 million for product and intellectual properties registration; approximately $2.4 million for working capital and other general corporate purposes.”

No comment on setting aside funds for commercialization warrants Regencell will need to produce a shelf offering or construct another convertible note in case they decide to proceed with the commercialization of their Traditional Chinese Medicine formulas.

Finally, Regencell has been burning through cash at an increasing clip rate. This should be of major concern to investors as we feel that Regencell is misallocating funds to conduct non-scientific “research studies” and excessively spending on high-end apartments in Honk Kong.

The IPO Underwriter With A Stellar Track Record

As if the cherry on top, the sole underwriter of Regencell is none other than Maxim Group. I’m sure your eyes are tired from reading this report, so I’ve attached a rough summary of how Maxim’s recent IPOs have performed below:

Conclusion

Failure to disclose Sik-Kee Au’s professional misconduct, renting luxury apartments, and continuation of non-scientific studies does not bode well. Given Regencell’s loose reporting requirements, we believe retail investors who buy into the hype press-release cycle will be left holding the bag when the dust settles in the coming months.

Current Share Price: $35.70

PT: $0

Est. Downside: 100%

My thoughts and prayers are with the heroic people of Ukraine as they fight for their freedom. This is a great resource of Ukraine charities for those able to contribute towards their aid—a huge shoutout to those on Fintwit who have offered to match donations. Good will prevail in the world.

Till next time,

Peabody

Disclaimer: This report is solely for entertainment purposes. I am not a registered investment advisor; this report does not constitute investment advice of any sort. I do not have a position in the security mentioned above, nor will I be initiating one.

If you like this report, and want to see more, please subscribe below