Lightwave Logic: Light Years Away From Reality

A short thesis on misled investors, failure to commercialize technology, and a billion dollar glorified academic lab

Would you invest in a company that for the past 25 years of its life has earned no meaningful revenue, made little progress, and yet its stock has increased by 650% this year alone. We introduce to you Lightwave Logic ($LWLG), a 25-year old development stage company that bills itself as a photonics company which technology is too difficult for many investors to understand. Perhaps this paragraph from the co-founder & past president of Lightwave Logic (formerly known as PSI-TEC Corporation), Frederick Goetz, will shed more light on what the company does. For context, this excerpt was from a press release Goetz published in October 2006—we recommend you read it in its entirety to better understand Lightwave’s track record of stringing investors along.

“PSI-TEC Corporation has been developing a technology that has been referred to as "the holy-grail" of telecommunications in scientific journals. Over the past two decades, numerous large and heavily invested industrial interests have unsuccessfully attempted to fabricate materials such as those which we believe we have recently demonstrated over the past four months. (Goetz, Co-Founder of Lightwave Logic)

Based off deep due-diligence, we believe Lightwave Logic ($LWLG) is grossly overvalued due to misleading investors, failing to commercialize on its technology for 25 years, and treating the company as no more than a glorified academic lab. We present the following as evidence of these allegations.

Misleading Investors

We believe Lightwave Logic’s CEO, Dr. Michael Lebby, has engaged in misleading and wrongful statements regarding the potential of Lightwave’s technology. Below is a summary of our findings:

CEO of Lightwave Logic, Dr. Michael Lebby, misled investors by claiming an experiment conducted by Polariton Technologies that used Lightwave’s product, Perkinamine chromophores, achieved a “new world record for a racetrack plasmonic modulator” in a company press release dated September 16th, 2021. The statements made in the press release by Dr. Lebby were based on a academic paper written by employees of Polariton. Lightwave submitted the paper to ECOC exhibition this year. Upon obtaining a copy of the published paper, we came to the conclusion that Lightwave fundamentally exaggerated its role in the experiment.

Lightwave’s role in the paper was only implicitly addressed as providing the organic EO materials. Based on Lightwave’s most recent quarterly statement, Lightwave did not receive revenue from Polariton for the use of its Perkinamine chromophores, hence demonstrating Lightwave Logic’s Perkinanmine chromophores are potentially unworthy of financial investment.

There is no public acknowledgement of any third party institution saying that Lightwave Logic & Polariton have achieved a record of any sort. Furthermore, there is no mention of “a new world record”, “world record”, or “record” in the academic paper. No employee or affiliate of Lightwave Logic was listed as an author in the paper.

To play devil’s advocate: we propose that our research is fundamentally wrong. Let’s say Dr. Lebby and Lightwave Logic have in fact set a “new world record” and made a groundbreaking discovery. If Lightwave had produced anything meaningful from this experiment, don’t you think it would have received unbiased media attention, new sales, and proposed partnerships. Yet, it’s received none of that giving us substantial reason to doubt the company’s potential; even then its ability to commercialize its existing technology is second-rate.

Failure To Commercialize Technology

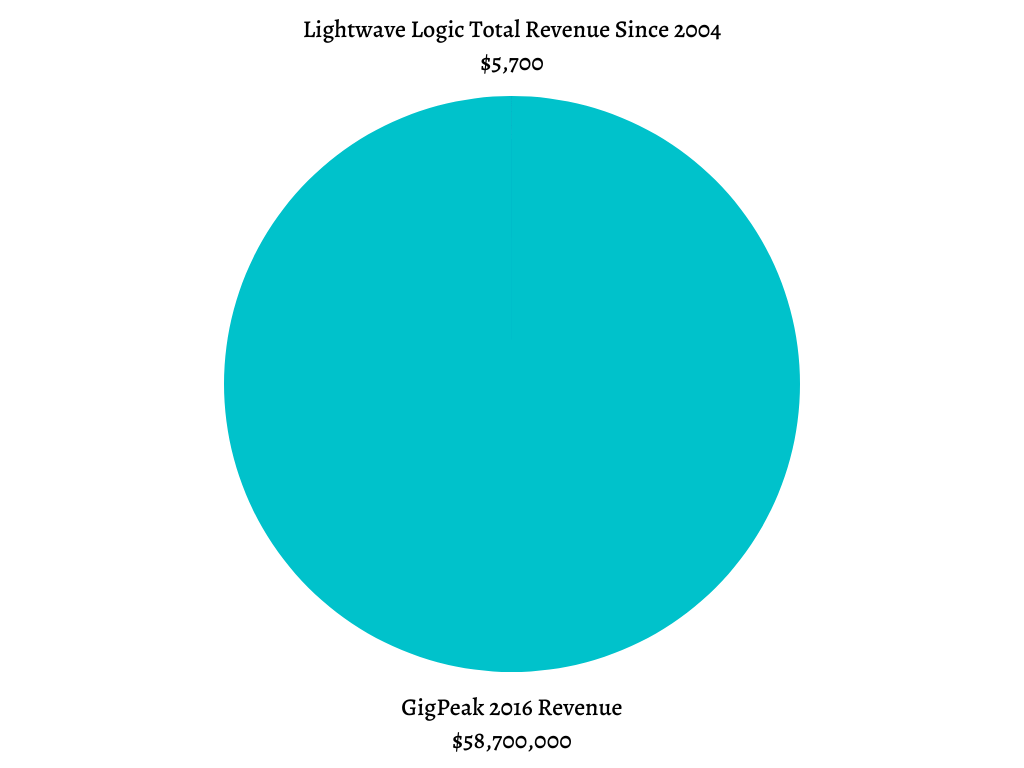

Since 2004, LightWave has been a publicly traded corporation which gives us transparent access into the financial upside of its “holy-grail” technology. Lightwave Logic has recorded minimal sales ($5,700 to be exact) since becoming a publicly traded company in 2004. In August of 2013, Lightwave announced it had made its first polymer sale to the University of Colorado’s Guided wave Optics Laboratory. Lightwave’s CEO and Chairman at the time, Tom Zelibor, said of the sale:

“Even though this represents only a small amount of our material and revenue, if successful it could lead to more significant sales. I am also pleased that our long-term relationship with Dr. Alan Mickelson and the Guided Wave Optics Lab at University of Colorado and BNS will provide an opportunity to showcase our material in an advanced DoD (Department of Defense) application.”

We interpret that the quality of Lightwave Logic polymers sold to the University of Colorado were poor as “significant sales” following this sale failed to occur, contrary to Zelibor’s speculation.

Lightwave Logic has made little effort to commercialize their technology based on investment in human capital. Based off the digital footprint of Lightwave Logic employees, we find that Lightwave currently does not employ a sales force of any sort. Furthermore, there was an individual previously employed by the company that had worked in a lead sales/marketing function for Lightwave Logic (said individual is no longer with the company). Failing to replace this individual and actively recruit a sales & marketing team shows further proof of the disinterest Lightwave Logic has in commercializing their technology.

Lightwave Logic has had only recognized $5,700 in net sales since its inception in 2004. For a company that touts its product as helping to set a “new world record”; we think having $5,700 in sales over the course of 18 years should warrant some sort of world record.

Finally, Lightwave Logic cited Gigpeak as a primary competitor stating “GigPeak, Inc. may be considered our primary polymer competitor” in their S-1 filed on April 19, 2017. Prior to Gigpeak being acquired by Integrated Device Technology (IDT) for $250M in 2017; GigPeak did $58.7M in revenue for their 2016 fiscal year. Relatively, Lightwave Logic clocked $0 in revenue for the 2016 fiscal year.

Glorified Academic Lab

The work Lightwave Logic does belongs more in a university research lab than it does on the NASDAQ. Lightwave Logic has a pristine track record of over promising and under delivering to its investors. 70+ patents and patent applications, millions of dollars in R&D, and hundreds of trivial press releases put out over the course of 18 years as a publicly traded “developmental” company. What is there to show for it? $5,700 in net sales, failed partnerships, and self-proclaimed world records.

Lightwave Logic can & should rebuttal my short thesis, of which I expect them to contend that I do not comprehend the magnitude of its technology. I will be the first to admit that I do not have a PHD nor do I absolutely understand the science of photonics (I do happen to have common sense). Lightwave Logic has projected they can adequately operate with its current cash till March 2023. Lightwave Logic’s past attempts to monetize its work have failed and we anticipate future attempts at monetization will fail. If Lightwave Logic claims to be monetization ready with its technology and ready to enter the sales cycle we present this gem from Lightwave Logic’s 2020 10-K:

“Many of our products will have long sales cycles that involve numerous steps, including initial customer contacts, specification writing, engineering design, prototype fabrication, pilot testing, regulatory approvals (if needed), sales and marketing and commercial manufacture.”

Seeing that they currently lack a sales force of even one, Lightwave Logic likely will run out of cash before they can generate meaningful revenue. Hence, Lightwave Logic will be forced to take further cash from Lincoln Park Capital per its financing agreement as retail shareholders will be left holding the bag. Reality awaits Lightwave Logic.

Current Share Price: $9.65

Price Target: $0.13 (Cash & Cash Equivalents+Equipment Value Divided By Shares Outstanding)

Estimated Downside: ~99%

I am a big believer in giving credit where its due. Props to White Diamond’s past research on Lightwave Logic which can be viewed here.

***Disclaimer: This report is written strictly for entertainment purposes. Nothing in the report shall constitute investment advice of any sort. We are biased investors and as such may take a financial position in the company written about above.

I have no affiliation with White Diamond or Adam Gefvert. Sorry you all feel this way about the research; I put out this research in hopes of warning retail investors of the significant downside. Would love to hear the bull case for Lightwave, such as when they'll generate revenue.

LWLG soaring lately due to an announcement that an unnamed company has requested some form of arrangement regarding LWLG's Perkanamine chromophores. Not sure if this means LWLG will actually, truly record a sale for the first or second time in their entire existence.