How much of your personal data is for sale? The short answer: your entire life for the right price.

Meet Red Violet (NASDAQ: RDVT), a $350M company specializing in selling personal data to realtors, private investigators, collection agencies, and more. Ironically, when we stumbled upon Red Violet, we originally researched it as a long idea given their growth story seemed compelling. Yet, deep below the surface, we discovered a litany of negative issues which are listed below:

Interactive Data LLC, a core subsidiary of Red Violet, is currently being sued for providing an inaccurate criminal record to a third-party background check company which in turn cost the suing plaintiff an employment opportunity

The lawsuit opens pandora’s box for litigation regarding individuals or entities that have been slighted by Red Violet for furnishing inaccurate consumer reports

More importantly, the lawsuit brings into question possible violations of FCRA; Red Violet’s legal team has been hard at work skirting FCRA regulations

Action by Florida’s Attorney General and/or the FTC regarding FRCA violations could be of significant detriment to the company’s financial position and be deadly for shareholders

Glassdoor Reviews on Interactive Data/Red Violet reveal disenchanted employees. Beyond bad employee reviews, employees of Interactive Data/Red Violet have taken to the courtroom to air their grievances:

A class-action lawsuit was filed by multiple sales staff over unpaid overtime in 2018—the lawsuit was resolved with a settlement

A sales team member was promptly fired in 2021 for reporting to his superior that he had pneumonia—the salesperson as a result sued and the case is currently in arbitration

Red Violet’s reliance on commodity data providers makes them susceptible to increased competition; their inability to turn a profit is further cause for concern

The Lawsuit Opening Pandora’s Box

On February 22, 2022; a class-action complaint is directed at Interactive Data, LLC, in which the plaintiff alleges she was not hired for a position because of an inaccurate consumer report constructed by Interactive Data. The plaintiff, Tabitha Parker, applied for a job at Stellar Partners where she was subject to a background check. Stellar had contracted out their background check process to OSA Consulting Group, LLC. In Parker’s case, OSA Consulting Group purchased a consumer report on Parker from Interactive Data LLC which in turn OSA “repackaged and sold” the report to Stellar. Below are direct allegations from the complaint explaining how badly Interactive Data screwed up Parker’s report, it’s worth the read:

The lawsuit goes on to mention this key statement; parentheses are added for clarity :

“It was not until after she (Parker) sued Osa and Stellar in another lawsuit that she learned the consumer report was originally purchased from Defendant (Interactive Data).”

A lawsuit battle Parker waged with OSA & Stellar resulted in an off-the-books settlement per court records & as a result Interactive Data was ratted out. You might be asking yourself why the hell this is relevant, so here’s the spark notes version:

When an employer uses consumer reports to make employment decisions such as “hiring, retention, promotion or reassignment, you must comply with the Fair Credit Reporting Act (FCRA).” The FTC is in charge of enforcing the FCRA

Red Violet’s legal team uses Jedi magic tricks to circumvent compliance with the FCRA by using a multitude of disclaimers in marketing materials and contracts

However, if an employer uses a consumer report to reject a job applicant or terminate an employee, they must furnish a copy of the consumer report to the applicant/employee allowing them an opportunity to ensure the info provided is factual

In Interactive Data’s case, they did none of that as the lawsuit alleges. In fact, when Parker originally reached out to Interactive Data, they refused to give a report citing they did not need to as they were not governed by FCRA regulations

Yet, the report was used to make an employment decision therefore Interactive Data is in violation of the FCRA

As a result, you have a two-fold negative outcome. There’s a pack of savvy employment litigators knocking at Red Violet’s front door for justice. We can expect other victims of Interactive Data’s negligence to file civil lawsuits against them if Parker’s lawsuit is successful. More importantly, the FTC could enforce penalties against Interactive Data which we believe would have a negative detriment to Red Violet’s financials as well as their customer base. No company wants to run the risk of purchasing an inaccurate consumer report as it could directly open them up to litigation which we saw in Parker’s case vs. Stellar Partners.

Failing to inform shareholders of this lawsuit, and the financial impact it could have on the company is of grave concern to us. We’ve attached a copy of the civil complaint here to give investors a better idea of what they’re getting themselves into.

An Uncertain Company Culture

As cliche as it may sound, the core of a company is its people. Red Violet appears to be in excellent company given early executive and big-time investor, Michael Brauser & Phillip Frost have previously settled charges with the SEC for stock manipulation. However, they’re no longer with the company and we’re not here to re-open a wound.

Instead, a quick glance at Glassdoor reviews of Interactive Data reviews some of the following cons listed by employees:

“This is hands down the most toxic work environment I have ever experienced. The executive team and management only care about themselves and how much the stock price is fluctuating. Run away fast unless you like to feel that your job is in jeopardy everyday.”

“A lot of micromanaging, people getting fired out of nowhere”

To start, the reviews on here are very good because the managers are asking employees to go on here and leave a good review. This company will let you go in a second. The customer does not come first. The C level guys want nothing to do with the employees.

“Everything... from lying about the entire position during the interview process, to making AE's look up peoples backgrounds w/o consent. They lie about the commission structure as well.”

While we’re skeptical to solely rely on employee Glassdoor reviews, they left us one helpful clue. In May of 2018, a group of account executives employed by Interactive Data/Red Violet filed a class-action over unpaid overtime wages. The case was settled out of court, however, we find it peculiar that sales staff would file a class-action against their employer.

More doubt over the company’s culture pops up when we continued to pour through court records. In September 2021, a former sales manager sued Interactive Data & Red Violet for firing him in July 2021 for violating the company’s “Covid-19 protocols.” However, the former sales manager claimed he was fired because he had requested sick leave as he was experiencing pneumonia & Covid-19. The case is currently in arbitration.

Ask yourself, is this a company you’d want to work for? A poor company culture could significantly affect Red Violet's ability to close sales and retain current employees. Not many ace sales reps are going to want to work for a company where you sue to get paid & get fired when you’re sick. I’ll pass on applying to work at Red Violet.

A Commodity Product With Uncertain Upside

In an interview with Bloomberg back in 2016, CEO Derek Dubner bragged about having built a profile on every American adult; even going on to say “We have data on that 21-year-old who’s living at home with mom and dad.” While they might have a profile on every American adult, there’s a chance it’s wildly inaccurate as Parker’s lawsuit has shown firsthand.

Red Violet serves as a downstream market player in the digital data world relying on a handful of key suppliers with one such supplier accounting for 49% of its total data acquisition cost (2021 10-K). Given key competitors of Red Violet have access to similar data, we are uncertain about its ability to continue expanding its current 62% gross margin. Fat margins can often be an invitation for increased competition. They’re dozens of services similar to Red Violet such as Tracers & TLO which are more commonly used among private investigators. Per an inquiry with a private eye, we learned that many of these aggregative services spit out faulty data or incorrect connections that need to end up being verified manually. The cost-benefit of using services such as Red Violet appears low if reports have to be manually checked for accuracy. Furthermore, using such a service in an HR setting opens up companies to civil lawsuits when these data services provide false information in a background check. Don’t fool yourself, Red Violet is no Palantir.

You’d think a company advertising that it has built a profile on “every American adult” would take cybersecurity seriously. Yet, that’s not the case. Amid the pandemic, a group of Covid-19 economic relief scammers somehow gained access to certain individuals profiled in Interactive Data’s database. An investigation by Krebs on Security revealed info the scammers gained directly from Interactive Data’s database:

Full Social Security number and date of birth; current and all known previous physical addresses; all known current and past mobile and home phone numbers

the names of any relatives and known associates; all known associated email addresses

IP addresses and dates tied to the consumer’s online activities; vehicle registration, and property ownership information

available lines of credit and amounts, and dates they were opened; bankruptcies, liens, judgments, foreclosures, and business affiliation

It’s odd Interactive Data/Red Violet would collect all this info when they claim to not sell/produce consumer reports. States with strict privacy laws such as California would have a field day investigating the scope of data Red Violet has in their possession. Side note— if you’re a resident of California it might be worthwhile asking Interactive Data for your report; I’m curious to hear their response.

To add a quick tidbit, Red Violet only achieved profitability in FY 2021 through the extinguishment of a $2.2M debt thru the CARES Act.

The bright spot of Red Violet’s company is a product called FOREWARN. FOREWARN is utilized by realtors to perform background checks on possible clients & costs $20 per month. For example, a realtor could see if a possible client is a sex offender, has a criminal record, etc. FOREWARN dominates the market with this product currently boasting 82,419 users. While the data is still being pulled via third-party providers, FOREWARN seemed legit at first.

To better understand FOREWARN, we scraped their website’s news page to better understand their clientele and upside growth potential. For context, FOREWARN consistently issues press releases on new deals they sign with brokerages and Realtor associations. As of March 15th, there was a record of 60 brokerages and Realtor associations having deals with FOREWARN that represented at least 176k agents/realtors.

At first glance, this seems impressive. Forewarn converts roughly 47% of the realtors/agents into its product from brokerage/realtor association contracts. However, the CEO of Red Violet, Derek Dubner, stated in the Q3 2021 earnings call, “Over 165 Realtor Associations throughout the US are now contracted to use FOREWARN.”

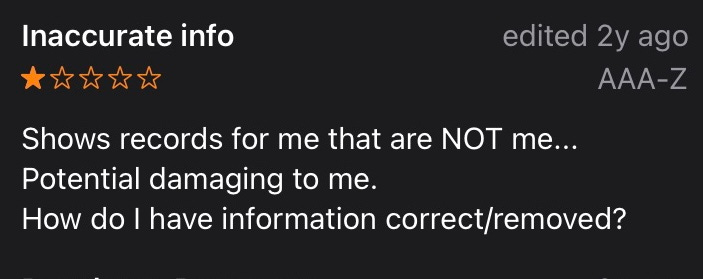

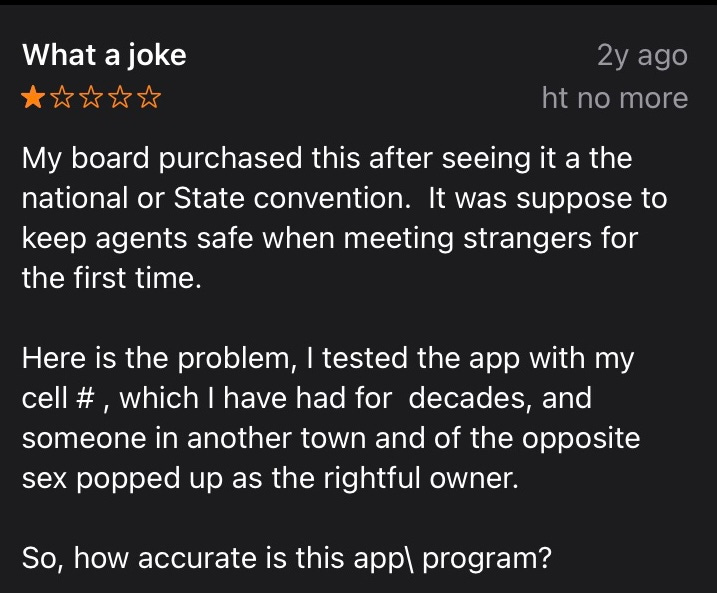

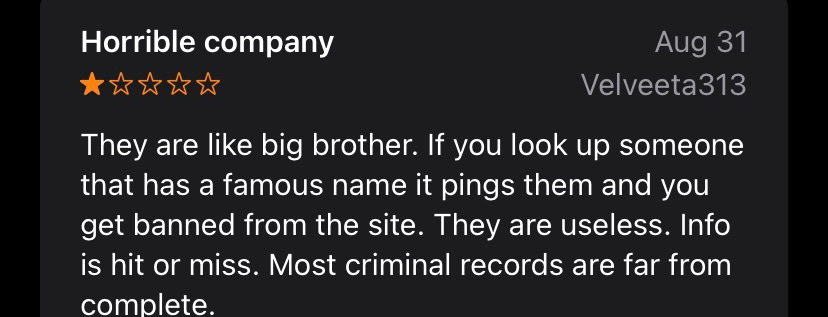

There is now a significant discrepancy between Dubner’s 165 contract figure and the 60 contracts FOREWARN has publicly announced on their website. However, if Dubner is correct in that FOREWARN has 165 Realtor Associations contracted to use their product, this means their market penetration rate is much lower hence the target market size shrinks considerably. With that, future growth will become more difficult to come by. It appears that the FOREWARN product is subject to similar incorrect information issues that have plagued Interactive Data per App Store reviews:

Red Violet is competing in an incredibly competitive industry, refusing to comply with FCRA regulations will only serve to their negative detriment. Scammers targeting their trove of data only worsen the equation as another cybersecurity breach could have dire consequences. That coupled with Dubner either inflating contract volume by nearly 3x or having a significantly less take rate on contracts serves no benefit to the bottom line and future growth prospects.

Conclusion

Litigation and possible FCRA violations, poor company culture, & an inaccurate product do not bode well for any stakeholder. Employee attorneys looking into Red Violet’s $34M cash coffer only make matters worse for shareholders.

The growth story doesn’t add up here; buyer beware.

Current Share Price: $26.30

Target Price: $6.50

Est. Downside: -75%

Happy Hump Day,

Peabody

PS: Feel free to drop a line at peabodystreet@protonmail.com

Disclaimer: We are not a registered investment advisor; anything in this report does not constitute investment advice. We currently do not hold a short position in Red Violet nor do we intend to initiate a position. Please do your own due diligence.

I am a reporter writing about Forewarn and Red Violet and would love to talk to you about the product. Please call me at 202-409-7714 or write to suzanne.smalley@therecord.media to connect. Thanks, Suzanne

As a broker, there are pros and cons. It took me three years to get erroneous information off my personal FOREWARN report. Impossible to deal with as they have ZERO customer service and/or follow through.